How to get the minerals we need in a clean energy future

Explainers

Securing the critical minerals we need for a green energy future will require cleaning up mining practices, boosting recycling and innovating to be less dependent on them altogether.

Countries are already boosting efforts to obtain critical minerals.

The European Commission, the European Union’s executive arm, is set to unveil as soon as Thursday a package of proposals meant to make it easier to extract these resources domestically, as well as create new international partnerships.

The journey minerals take into the electric cars, solar panels and wind turbines we increasingly see around us follows many steps along a complex supply chain that often involves energy-intensive practices.

Let’s start where it all begins: mining. Next we’ll move to other ways to manage our minerals more wisely.

It can take, on average, 16 years to move mining projects from discovery to first production, according to the International Energy Agency.

The process requires numerous steps, including designing the mine, installing infrastructure and digging tunnels—not to mention lengthy and often difficult permitting procedures.

On top of those routine challenges, mineral concentration in ores (natural rock or sediment containing valuable metals or minerals) has declined in recent years for a range of key minerals, the IEA said. That means extracting them requires more energy (traditionally from fossil fuels), more emissions and more waste.

Mining has a controversial reputation, including often negative impacts on the environment and unsafe conditions for workers (this latter point is equally important, though we don’t touch on it today).

Companies are exploring ways to clean up extraction processes.

“Technology investment would be one of the best mitigation strategies for miners to have less impact on the environment,” said Sung Choi, metals and mining analyst at BloombergNEF.

Take, for example, London-based Savannah Resources, which wants to build Europe’s largest open-cast lithium mine in Portugal to meet growing demand for electric vehicle batteries. The company has faced strong public opposition to the project.

The company outlined plans last month to decarbonize its operations by using battery-operated electric mining equipment powered by renewable energy instead of fossil fuels. French mining company Imerys is looking at similar solutions for its lithium mining projects.

In addition to learning how to mine more sustainably, we’ll also have to find new deposits deeper underground—and fast. Innovation in this space is picking up.

California-based start-up KoBold Metals uses artificial intelligence to help determine where to survey and drill. In December, the company said it’s investing $150 million to develop a copper mine in Zambia. Canada-based Geologic AI also uses artificial intelligence as part of its mineral scanning technology to track deposits faster and with more accuracy.

Some technologies are seeking to skip conventional mining entirely.

Australian-based Vulcan Energy Resources wants to create the world’s first zero carbon lithium project in Germany’s Upper Rhine Valley by tapping into the region’s vast geothermal and lithium brine resources.

The plan—with construction starting this year—is to pump hot, salty water (known as brine) up from three miles (five kilometers) underground, extract the lithium from the brine and use the heat to power the company’s operations and sell excess renewable electricity to the grid and heat to local communities. The extra brine is injected back into the ground.

It’s a win-win, said Cris Moreno, deputy CEO at Vulcan Energy Resources.

“We’ve just taken the benefit of clearly bolting together a geothermal project with a lithium extraction project,” Moreno said. “We create almost no waste in our process.”

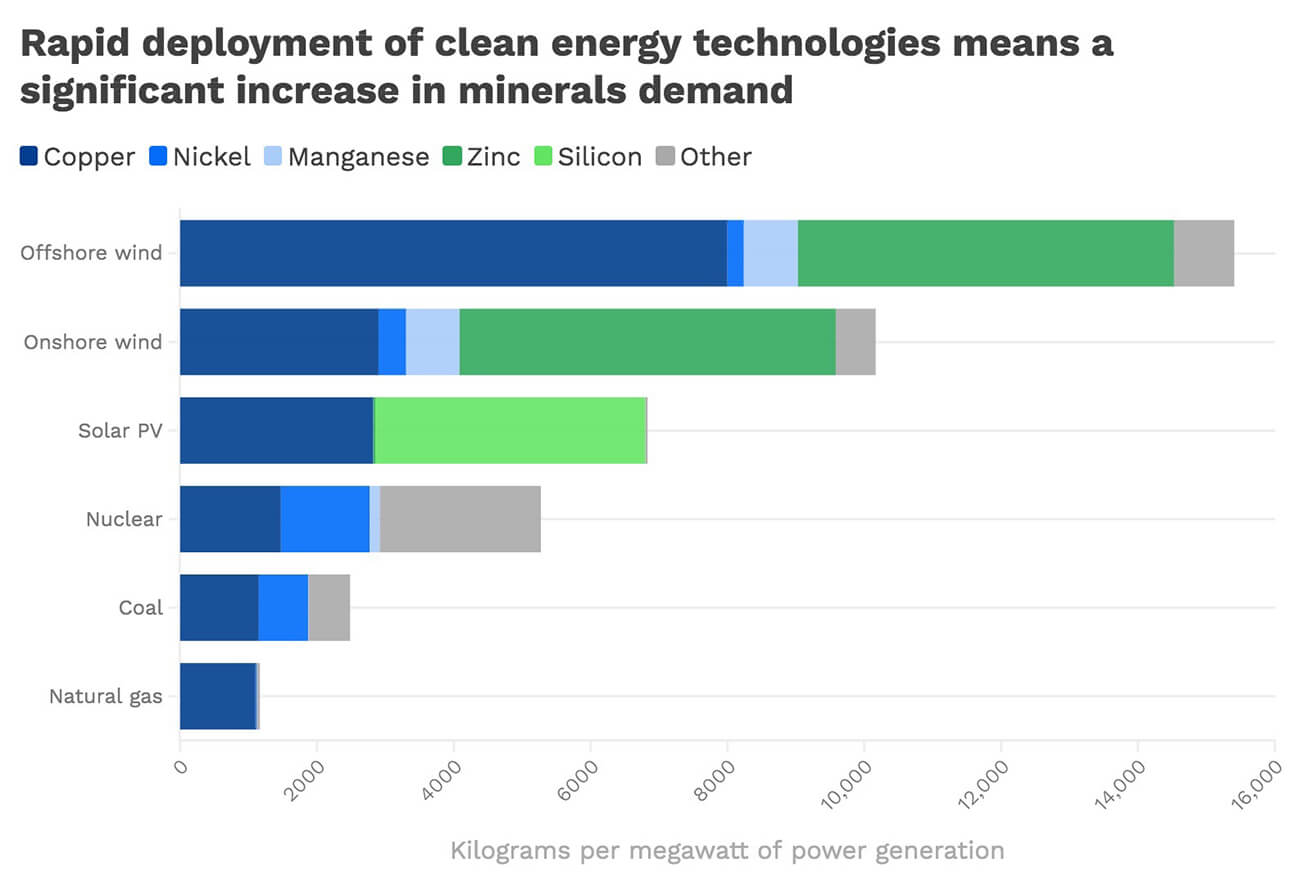

Source: International Energy Agency “The Role of Critical Minerals in Clean Energy Transitions” • This chart provides a snapshot of key minerals and technologies and is not exhaustive. Steel and aluminum are not included.

We also need to manage our minerals more wisely, which could help limit our need for new materials.

Recycling will be increasingly important as we grow more dependent on clean energy technologies that will have to be retired at recurring times in the coming decades.

By 2040, recycling large quantities of copper, lithium, nickel and cobalt from spent batteries—a challenging process—could reduce combined supply needs for these minerals by around 10%, the IEA said.

Increasing recycling rates of lithium would mean mining capacity for the mineral would expand eightfold from 2021 to 2050, instead of 13-fold should recycling rates remain constant.

Competition in the mineral recycling sector is growing.

Nevada-based Redwood Materials, one of the largest lithium-ion battery recyclers in North America, says its technology can recover on average 95% of the elements from the batteries it receives. It then refurbishes the materials for use in new electric cars.

Li-Cycle, a Canadian lithium-ion battery recycling company, has plans to expand beyond North America to Europe. European Commission President Ursula von der Leyen visited a company plant last week in Canada, signaling growing interest in the practice.

Major copper producers announced plans last week to reduce their emissions to net zero by 2050 by decarbonizing their power supply, improving efficiency and collecting scrap metal.

Innovating our way to reduced mineral dependency is another potential solution.

Using materials more efficiently or becoming less reliant on them altogether could limit demand increases for critical minerals subject to supply chain disruptions.

Benefits are already tangible today. A 40 to 50% reduction in how much silver and silicon used in solar cells over the past decade has “enabled a spectacular rise in solar PV deployment,” the IEA said.

Similarly, the amount of copper needed in an onshore wind farm is set to fall by 10% by the end of the decade, according to BloombergNEF.

Increased material efficiency can reduce the volume of rare earth elements needed to build the powerful magnets used in wind turbines. And switching to new types of electric vehicle motors that need fewer or no rare earth magnets compared to current EV models could also reduce demand for these minerals.

Tesla announced earlier this month plans to remove rare earth elements from future vehicle motors, part of broader plans to develop more efficient powertrains set to reduce factory footprints by 50%.

Work is also underway—for example by Massachusetts-based company Form Energy—to develop batteries for long-duration storage using iron (an abundant mineral), air, water and very small amounts of critical minerals.

Even with efficiency improvements, substitutions and recycling, the overall quest for minerals is set to significantly increase in coming decades.

Technological innovation can help improve the environmental footprint of these processes, “but thinking that we are going to have some kind of no-impact mineral and metal chain is…naive,” said Morgan Bazilian, director of the Payne Institute and professor of public policy at the Colorado School of Mines.

He added: “We have to balance those kinds of impacts with the other impacts of air pollution or climate change that the move to clean energy technologies is aiming for.”

Editor’s note: Investors at Form Energy, KoBold Metals and Redwood Materials include Breakthrough Energy Ventures (BEV), a program of Breakthrough Energy, which also supports Cipher.