The massive quest for the minerals we need in a clean energy future

Explainers

The rush toward a clean energy future means we need to dig, extract and process Earth’s resources faster and better than ever before.

Critical minerals, like lithium, copper and cobalt, are at the core of the world’s ambition to put more electric vehicles on the road, line more rooftops with solar panels and dot fields and seas with powerful wind turbines.

As the world shifts away from the legacy fossil-fuel system, green technologies and infrastructure will drive the demand increase for critical minerals over the coming decades.

To be sure, we’re talking about huge amounts of new resources, but still fundamentally fewer than our current energy system requires. Oil and natural gas must be continually extracted and burned to produce energy, whereas minerals once mined will be used for technologies with much longer lives, like solar panels or car batteries.

Technically, the Earth has enough reserves of these minerals to build all the cleantech it needs. But accessing them and doing so responsibly and quickly enough to meet rising demand is the challenge.

The quest to secure these minerals is leading to a realignment of geopolitical dynamics, new dependency concerns and a drive for innovation.

Let’s start with some definitions.

Minerals are extracted from the Earth through the mining of ores (naturally occurring rocks or sediments). The minerals are then processed in industrial plants to become the materials and metals required to build various technologies.

We won’t go back to chemistry class and tackle each mineral in detail, but here are a few facts (courtesy of a recent report from the International Energy Agency) to better understand what’s at stake.

A typical electric car requires six times the amount of minerals of a conventional car.

An onshore wind plant requires nine times more minerals than a gas-fired power plant.

Since 2010, the average amount of minerals needed for one new unit of power generation capacity has increased by 50% as the share of renewables has risen.

To reach net-zero emissions by 2050, the global cleantech sector’s demand for copper, lithium, cobalt, nickel and neodymium (a type of rare earth mineral) will range between three to 14 times higher in 2030 than in 2021.

Unlike other bulk materials essential to the transition made from abundant raw materials, like steel and aluminium, the minerals we reference here are particularly tricky to source given the difficulty accessing them and the fact that they’re not geographically widespread.

Copper, a malleable metal and excellent conductor of electricity and heat, is the “cornerstone for all electricity-related technologies,” the IEA said. The material, together with aluminium, is important for the expansion of power networks and the production of wind turbines, solar panels and electric vehicles.

Copper demand increases by 45% by 2030 in a net-zero scenario, the smallest percentage increase among five key minerals including lithium and cobalt. But that translates into the highest increase in terms of volume—just over one million tonnes per year on average by 2030, 90% of which will go toward clean technologies, according to a separate IEA report out this year.

“By some estimates, we will use more copper in the next 30 years than humanity has used in its entire existence,” Eric Toone, a chemist and technical lead for Breakthrough Energy Ventures, said in a speech at the Breakthrough Energy Summit last fall.

Global copper mining is expected to decline over the next few decades “if current reserves are not replaced with new geological discoveries and projects,” according to a January report by BloombergNEF shared with Cipher.

Lithium, nickel, cobalt, manganese and graphite are crucial to battery performance and longevity. Rare earth elements, such as neodymium, are key for building powerful magnets needed in wind turbines. Hydrogen electrolysers and fuel cells require nickel or platinum group metals.

Lithium, obtained from ore mining or salt deserts and used in electric vehicles and battery storage, has the fastest growing demand of any mineral. Lithium demand could grow by over 40 times by 2040, the IEA found. In a net-zero scenario, by 2030 almost all lithium on the market will supply the battery sector.

But lithium also has the largest potential supply gap, the IEA said, with anticipated mine expansions covering just two-thirds of projected need by 2030.

Demand for cobalt, mined as a byproduct of either large-scale copper or nickel mines, could be six to 30 times higher than it is today, depending on how battery chemistry and climate policies evolve.

Cobalt production is set to decline gradually over the coming decades and existing cobalt reserves will be depleted significantly by 2031 if new deposits are not discovered before then.

“Unless mining capacity ramps up more rapidly than the adoption of energy transition technologies, metals supply could present a real barrier to reaching net zero,” according to the BloombergNEF report.

The depletion of current mines is a concern because “the day of finding a deposit and digging a hole wherever you find it are over,” Toone said in the same speech last year. He was referring to growing public opposition to mining projects due to their environmental impact (more on that next week).

“There’s no fundamental medium or even long-term constraint on the resources themselves,” said Morgan Bazilian, director of the Payne Institute and professor of public policy at the Colorado School of Mines. “What there is, is a constraint on investment into mining and then the associated permitting and social license to operate.”

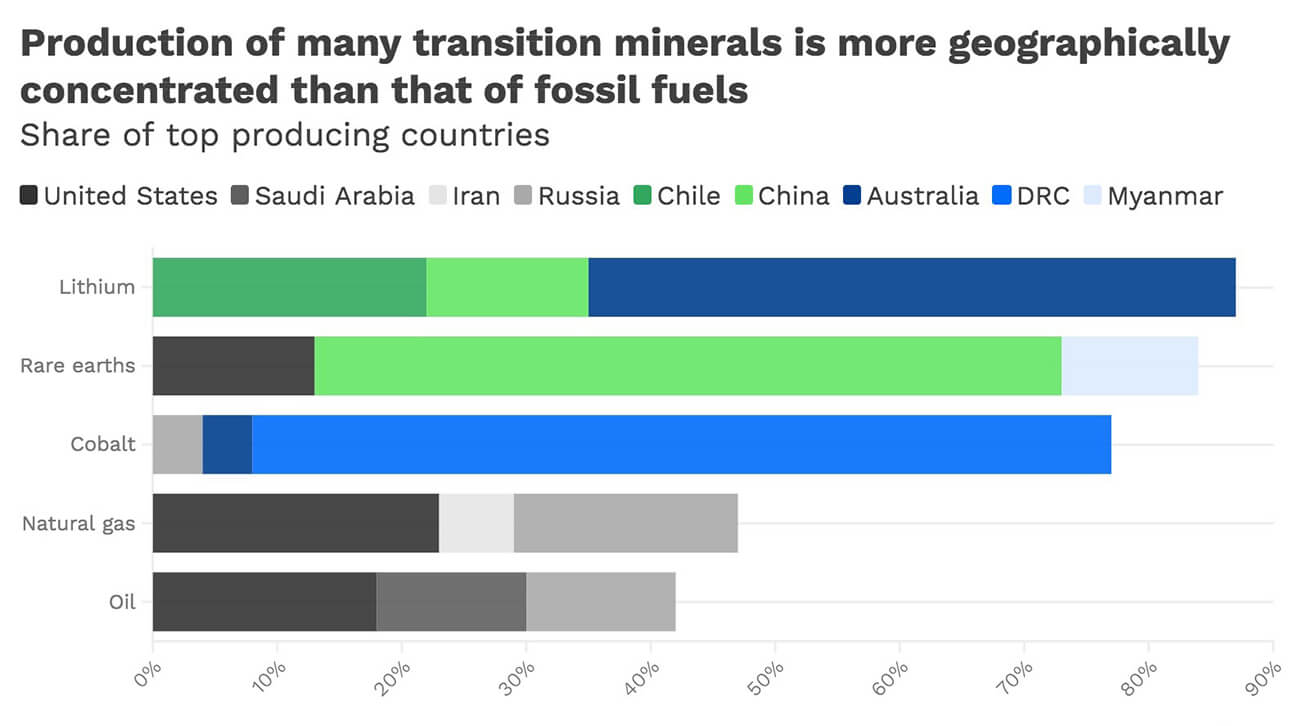

Needed critical minerals are more geographically concentrated than oil and gas resources, as is the current ability to process them into usable materials and metals. This raises questions about geopolitical influence.

Source: International Energy Agency • DRC stands for the Democratic Republic of the Congo. This chart provides a snapshot of key minerals and is not exhaustive.

The Democratic Republic of the Congo alone produces 70% of the world’s cobalt, and just three countries account for nearly 90% of global lithium production: Australia, Chile and China. A similar pattern exists for platinum, rare earth elements and graphite.

“We have a whole new set of demand drivers for these minerals and that is causing some stress to what are fairly small, not liquid, not well governed set of… different markets,” said Bazilian.

When it comes to further processing the minerals across the supply chain, China dominates, with more announced projects for the processing and refining of key minerals.

Many countries, including the United States and the European Union—which is set to announce plans next week to shore up its raw material supply—are scrambling to lessen their dependence on China both for the extraction and processing of minerals.

Editor’s note: Breakthrough Energy Ventures is a program of Breakthrough Energy, which also supports Cipher.